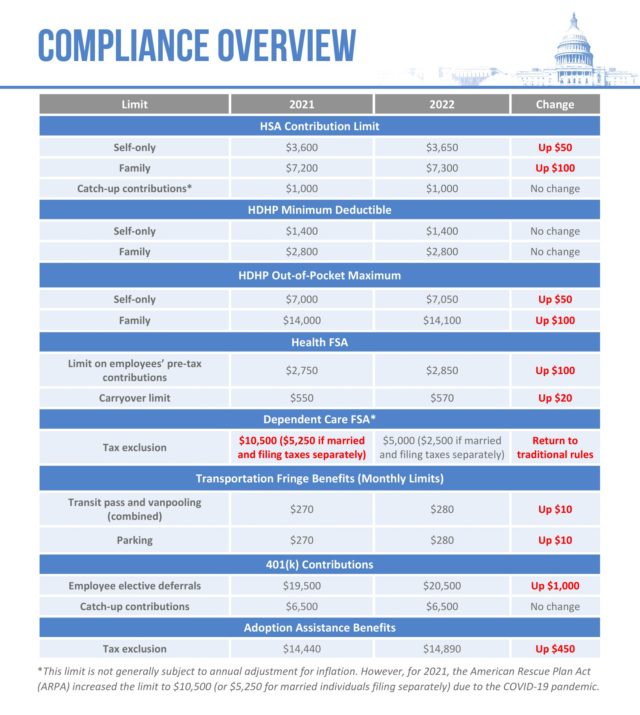

Many employee benefits are subject to annual dollar limits that are periodically updated for inflation by the IRS. The following commonly offered employee benefits are subject to these limits:

The IRS typically announces the dollar limits that will apply for the next calendar year well before the beginning of that year. This gives employers time to update their plan designs and make sure their plan administration will be consistent with the new limits. This Compliance Overview includes a chart of the inflation-adjusted limits for 2022. Most of the limits will increase, although some limits remain the same for 2022.

Links And Resources

|

Increased Limits

Unchanged Limits

|