HR TIPS

What Does an Employee Benefits Advisor Do?

Discover the services an advisor can provide and the criteria you can leverage to pick the right consultant for your organization.

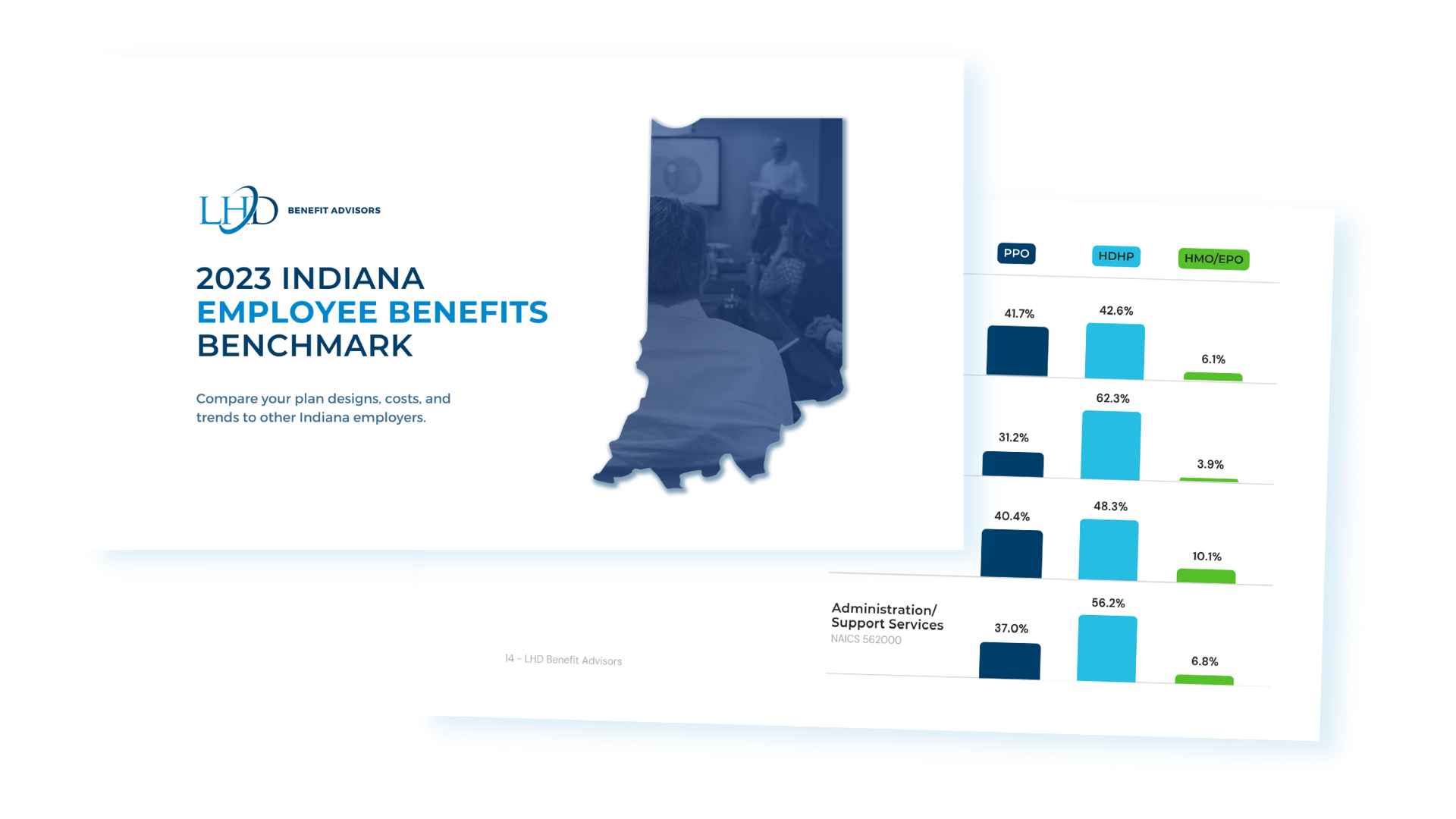

REPORT

2024 Employee Benefits Market Outlook

Addressing the challenges presented in this Market Outlook will be the key to employers’ success in 2024 and beyond.

HR TIPS

Employee(s) Missed Open Enrollment?

Communicating these potential consequences to employees will encourage them to take the open enrollment deadline more seriously.

Better Teams. Better Work. Better Service.

24 Years of Teamwork

Our teamwork inside and outside the office encourages hard-work, respect, and shared values. A strong team provides accurate and reliable service to every client.

0123456789001234567890

Average Years of Experience

012345678900123456789001234567890+

Related-Field Certifications

012345678900123456789001234567890+

LHD Sponsored Volunteer Hours

OUR ANNOUNCEMENTS

Latest News

Risks and Rewards of Offering Tax-Favored Accounts

Attend this month's webinar to learn about the benefits and risks of offering tax-favored accounts.

March 2024 Compliance Recap

ACA reporting is in its first year of the required electronic reporting for employers filing ten or more returns annually.

Qualifying Events and Special Enrollment Periods

Learn how the Internal Revenue Service (IRS) regulates employee benefit contribution levels and the timing of enrollment elections.

February 2024 Compliance Recap

February saw updated instructions to June 1 RxDC Reporting and 2025 Employer Shared Responsibility Penalties.

VALUES ARE OUR COMMITMENT TO YOU

Core Values

Our values are the foundation to putting clients first.

People

We are committed to hiring and developing talented people and empowering them to deliver forward-looking strategies and innovative solutions.

Trust

We are committed to acting with the utmost integrity and transparency in our daily interactions with employers, their employees, and each other.

Excellence

We are determined to deliver the highest quality and service possible through innovative, outcomes-driven solutions.

Teamwork

We work collaboratively to develop and nurture relationships based on mutual trust, respect, and accountability.

Innovation

We challenge ourselves to identify and apply creative solutions to address the changing needs of employers and their employees.