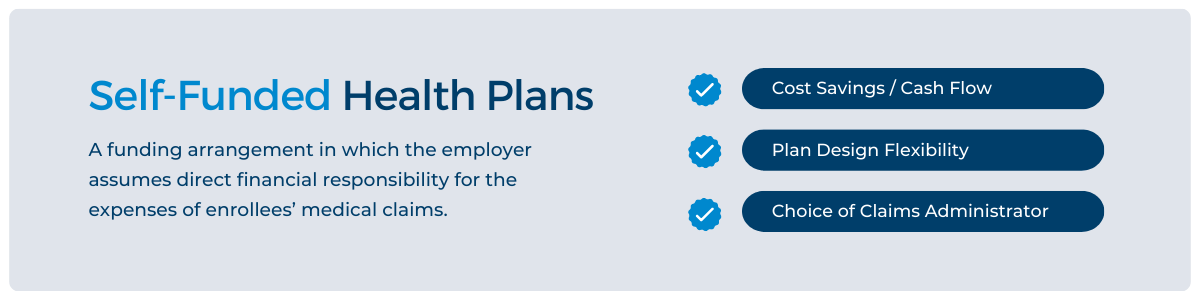

What Is a Self-Funded Health Plan?

Pros of Self-Funded

Cost Savings – Reduced insurance overhead costs. Insured contracts include costs for risk transfer, profit, and tax liability. Self-funded plans, unlike insured policies, reduce or in some instances eliminate these additional expenses.

Increased Cash Flow – There is a cash flow advantage in the year of adoption when “run-out” claims are being covered by the prior insurance policy. Employers pay as claims are incurred rather than fixed monthly premiums which allows the self-funded employer to earn interest income on any unclaimed reserves.

Plan Design Flexibility – Self-funded health plans provide employers with greater control, freedom and flexibility over plan designs.

Cons of Self-Funded

High Claims Risk – The main risks of self-funding involve situations where claims are higher than anticipated. While stop-loss coverage will protect employers from paying excessive claims in a given year, the cost of that coverage will likely increase, and it may be more difficult to get rates from other stop-loss providers. Higher-than-expected claims in a self-funded plan may also make it more difficult for employers to go back to a fully insured plan in the future.

Legal Liability – An employer’s assets may be exposed to liability as a result of any legal action taken against the plan. Legal matters involving self-insured plans can be complex.

High Administrative Costs – For organizations that choose to run their self-funded plans internally, the administrative costs involved can be significant

Finding a Qualified Third-Party Administrator (TPA) – Not every TPA is the same. An employer must do their due diligence to find a TPA that is experienced and nuanced in operating a self-insured health plan for their plan to run smoothly.

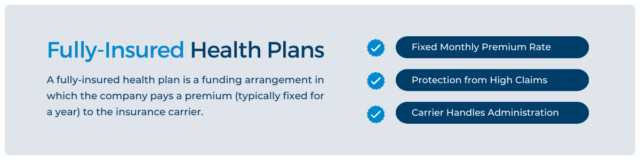

What is a Fully-Insured Health Plan?

A fully-insured health plan is a funding arrangement in which the company pays a premium (typically fixed for a year) to the insurance carrier. The monthly premium normally only changes during the year if the number of enrolled employees in the plan changes. The insurance carrier collects the premiums and pays the health care claims based on the coverage benefits outlined in the policy purchased.

Pros of Fully-Insured

Fixed Premium Rate – The monthly premium rates paid to the insurance carrier are fixed, generally annually, based on the number of employees enrolled in the plan.

Protection from High Claims – Because insurers assume the financial risk in a fully-insured contract, employers are shielded from paying large claims as they are incurred. These claims are paid by the insurer.

Cons of Fully-Insured

Tax Burden – Fully-insured plans are subject to state regulations and often pay more in taxes (vs. self-funded plans).

Less Plan Flexibility – A fully-insured plan’s design flexibility is often limited by the insurance carrier available options.

No Refunds (on Unused Care) – Insurance carriers can use the money collected from premiums however they choose–generally, they do not refund employers for money that isn’t spent on claims.

How to Decide Between Self-Funded vs. Fully-Insured Health Plans

Self-insurance isn’t the right option for every employer. When evaluating if it is right for their organization, employers should consider the following factors:

Stop-Loss Coverage – Most self-funded employers purchase stop-loss insurance on their self-funded health plan to reduce the impact of large claims on the entire plan. Obtain multiple different stop-loss coverage quotes for different coverage levels.

Coverage Goals – Decide on such things as eligibility, benefit coverage, exclusions, cost sharing, policy limits and retiree benefits. Weigh the self-funded plan advantages of flexibility and lower average cost versus the increased risk and administrative responsibilities.

Employee Health – Knowing facts such as whether your workforce is mostly young or old, whether the majority of claims were due to chronic illnesses or one-time incidents and the total dollar amount of claims will help you budget for claims in the future. Self-funding should be viewed as a long-term strategy in which good and bad years average out in the employer’s favor.

Cash Flow Analysis – Self-funded plans work best for companies that have a strong cash flow or reserves. Understand what your cash needs are so you have money available to make timely claim payments.